capital gains tax canada calculator

150000 x 50 75000. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate.

. Short-term capital gain tax or profit from the sale of an asset held for less then a year is taxed at the standard income tax rate. High net worth individuals and investors may need to consider the implications of capital gains tax on their personal finances and individual wealth management. If you add 350000 to 250k to 100000 you gain 175000.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000. Our free tool allows you to check your capital gains tax.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. It will also help you estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange Starker exchange instead of a taxable sale. In 2021 if individuals taxable income is between 40400 and 60400 there is no capital gains tax to worry about.

Since the self-employed income capital gains eligible and non-eligible dividends and other income are taxed differently this calculator will show you how much taxes youll have to pay. Since your property is in Canada 50 of the total capital gains profit is subject to tax. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2022.

The amount of tax youll pay depends on how much youre earning from other sources. Capital gain 134400 sales price 74910 adjusted basis 59490 gains due. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

A good capital gains calculator like ours takes both federal and state taxation into account. 2 days agoHow Do You Calculate Capital Gains On 2021. The calculator includes most deductions and tax.

That said its helpful for any investor to have a good. Nevertheless if they make 40401 to 445850 they will pay 15 percent of the gain on the capital gains. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223.

The sale price minus your ACB is the capital gain that youll need to pay tax on. When declaring capital gains from any disposition of capital properties you report these earnings using Schedule 3 which also covers other income sources that may not apply to you says Brent Allen regional director certified financial planner and. And the tax rate depends on your income.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. Do not include any capital gains or losses in your business or property income even if you used the property for your business. Canada Capital Gains Tax Calculator 2021 Table of contents Published 10122021 1512 EST.

The calculator will show your tax savings when you vary your RRSP contribution amount. How much these gains are taxed depends a lot on how long you held the asset before selling. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income.

Capital Gains Taxes on Property. You could gain capital gains by purchasing property for 250000 then selling it for 350000. 380000 328100 51900 a capital gain.

Some common types of capital property are. There are many rules around paying and not paying capital gains. Capital Gains Tax Calculator.

Capital gains in Canada are only taxable 50 percent. Completing your tax return. If youre feeling overwhelmed and uncertain if you need to pay capital gains or not its best to discuss your particular situation with a credible accountant or financial advisor.

Each capital gains calculator includes personal tax allowances tax deductions etc and provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay illustrations. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20. In Canada 50 of the value of any capital gains is taxable.

Calculate capital gain and capital gains tax liability by subtracting your adjusted basis from the price of the property then multiplying that by the long-term capital gains tax rate. If applying the formula for calculating a capital gain or loss results in a loss rather than a gain you can use your capital loss to reduce any capital gains you had in the year all the way down to zero if you have enough of them. 6500 - 4000 60 2440.

The total taxable amount for this property is 75000. How to Calculate Canada Capital Gains Tax in 5 Steps. This capital gains calculator estimates the tax impact of selling your show more instructions.

New Hampshire doesnt tax income but does tax dividends and interest. If You Have a Capital Loss Rather Than a Capital Gain. A capital gain occurs when you sell or are considered to have sold a capital property for more than the total of its adjusted cost base and the expenses incurred in selling the property.

Capital Gains Tax Calculator Real Estate 1031 Exchange. Now if the property is under your personal name the 75000 is added to your overall income. Those earning more than that poverty line experience a 20 percent increase.

For more information see Completing Schedule 3. Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. Assume the property is purchased and held.

In our example you would have to include 1325 2650 x 50 in your income. Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital gain at line 12700 on his income tax and benefit return. Canadian Tax Calculator 2021.

The Canadian capital gains tax can seem hard to understand at times. For 100000 50 percent is taxable and for 10000 50 percent is taxable. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. When day-trading profits do qualify as capital gains the resulting amount is reported annually with your income tax return. If you have income from sources other than employment use our tax calculator.

Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. The tax calculator is updated yearly once the federal government has released the years income tax rates.

Reporting Capital Gains Dividend Income Is Complex Morningstar

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Reporting Capital Gains Dividend Income Is Complex Morningstar

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Capital Gains Tax Calculator For Relative Value Investing

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Capital Gains Yield Cgy Formula Calculation Example And Guide

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Capital Gains Tax Calculator For Relative Value Investing

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Canadian Corporation Capital Gains Harvest Tax Calculator Physician Finance Canada

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

How To Calculate Capital Gains Tax H R Block

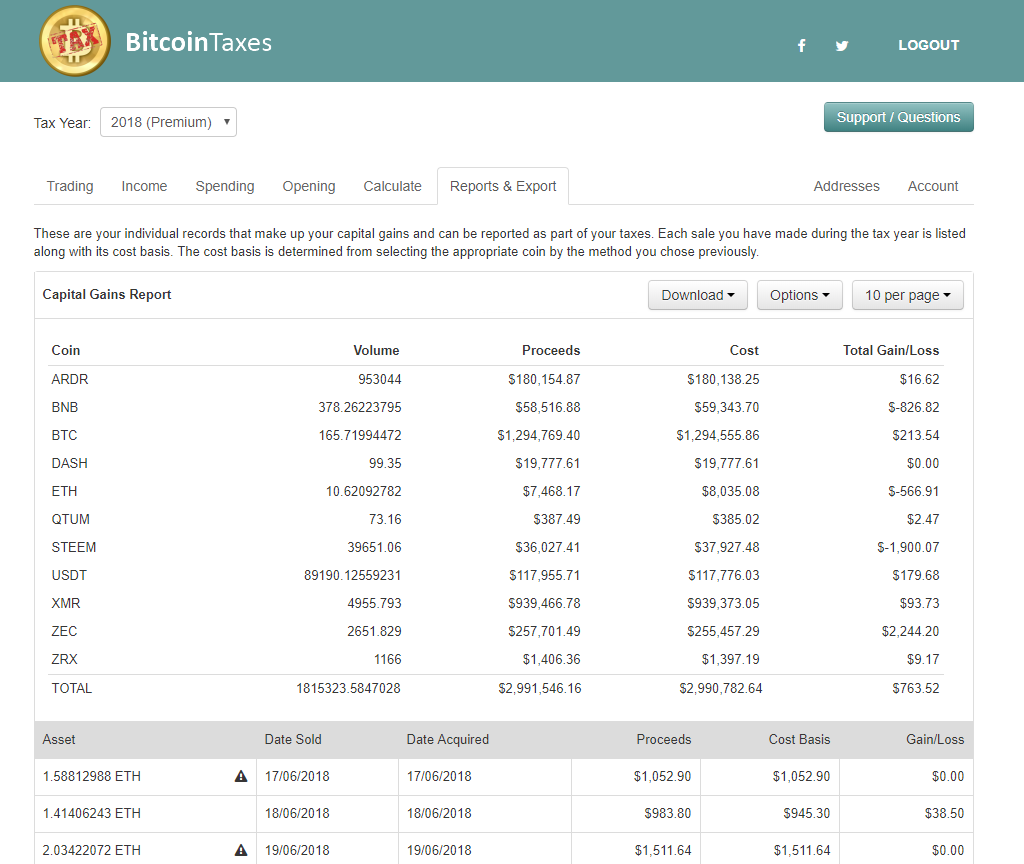

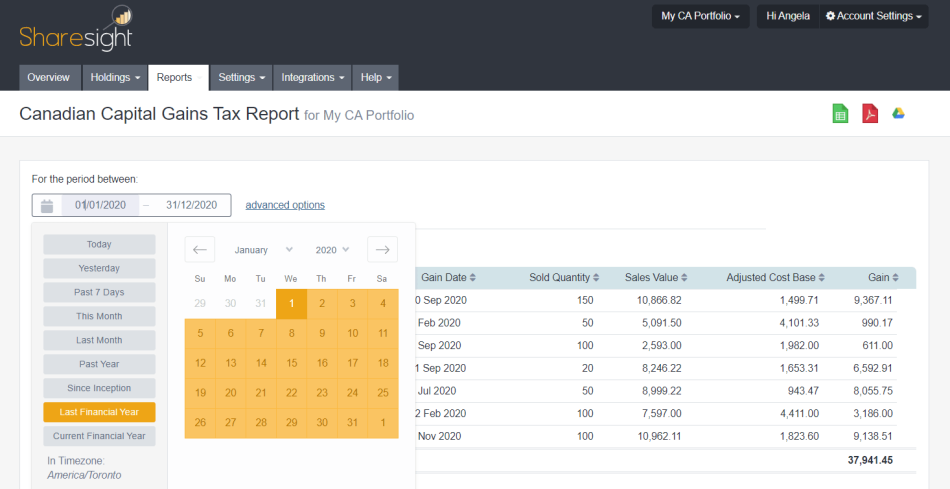

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight